AWS Market Share: Revenue, Growth & Competition

Amazon Web Services (AWS) was founded back in 2006 and was the first company to offer modern cloud infrastructure as a service. Since its launch, AWS has become a staple for both hosting and data storage in particular.

What is AWS?

Amazon Web Services (AWS) is a cloud service provider that uses Amazon’s own infrastructure and experience. Rather than a division of the company, like Microsoft’s Azure, AWS is a subsidiary company of Amazon.

AWS offers a wide range of cloud services, from basic hosting and deployment to analytics, blockchain, machine learning, and more.

All the storage and computing resources come from a distributed network of data centers spread across the globe, to facilitate less latency and a better experience for your end-users.

AWS offers a hosting and storage service called Amazon Simple Storage Service, more commonly known as Amazon S3, as well as elastic block storage, and more.

AWS Currently Has a 6% Market Share in Web Hosting

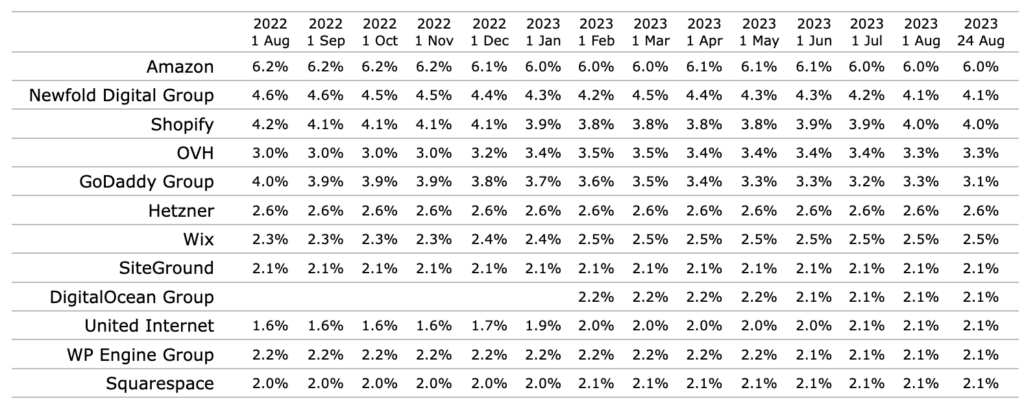

The first, and most accessible data, to examine, is AWS’s market share of the web hosting industry.

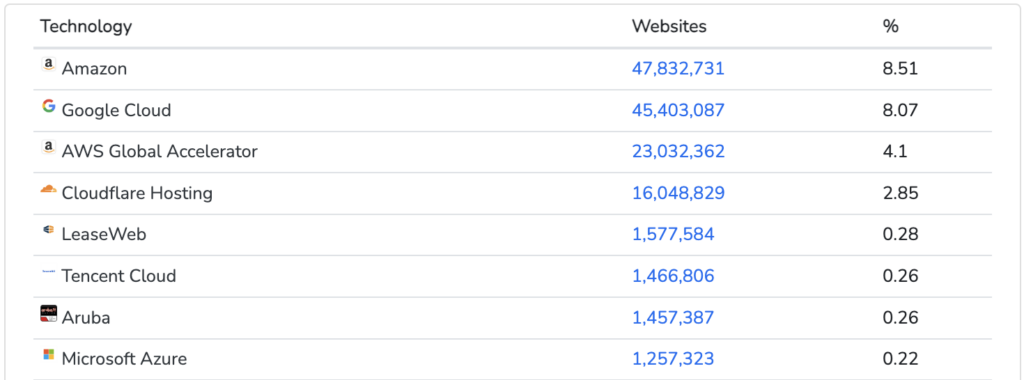

According to W3Techs, these are the current, up-to-date cloud market share numbers for web hosting services across the globe:

Amazon is in first place, with 6%. Google dropped from 5th place to position 13, with 1.9% after unexpectedly selling its domain-hosting business to Squarespace. Microsoft is the clear straggler at just 1.2% market share of commercial and private web hosting combined.

Even though AWS isn’t specifically a hosting company, they’ve already overtaken Endurance Group (behind cheap shared hosting giants Bluehost and Hostgator) and established a clear lead among the three cloud giants.

And if you don’t find the number 6% impressive, let’s take a closer look at what that actually means.

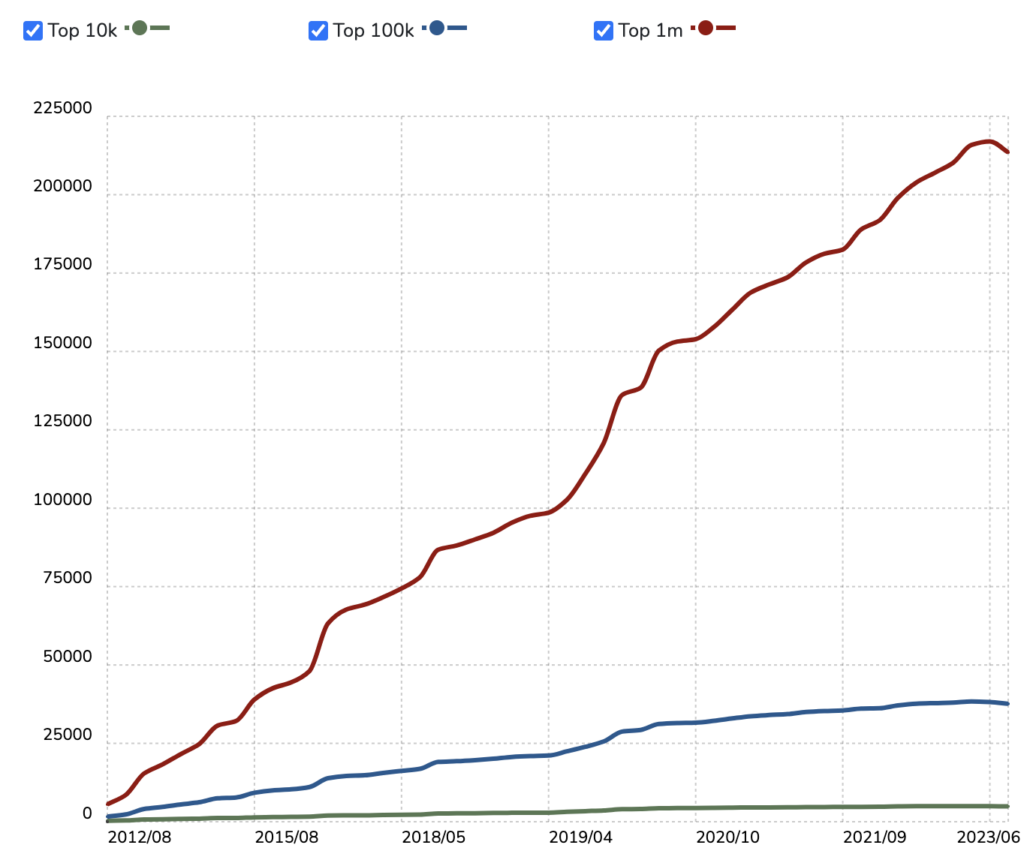

There are around 50 Million Live Websites Using AWS

Just a few percent of the web hosting market is a big deal. To further illustrate exactly how big, we’re going to look at the live number websites currently hosted by AWS.

According to BuilWith’s latest data, an estimated 49,963,267 live websites are hosted by AWS.

Amazon Usage Statistics

50 million. That’s more than the entire population of Spain.

AWS is the hosting service provider of choice for a lot of global enterprises and well-known companies, including Netflix, Airbnb, and 3M.

Because of data-intensive video, Netflix alone uses over 100,000 server instances for its storage and computing needs. Many leading companies use AWS to host their websites and data.

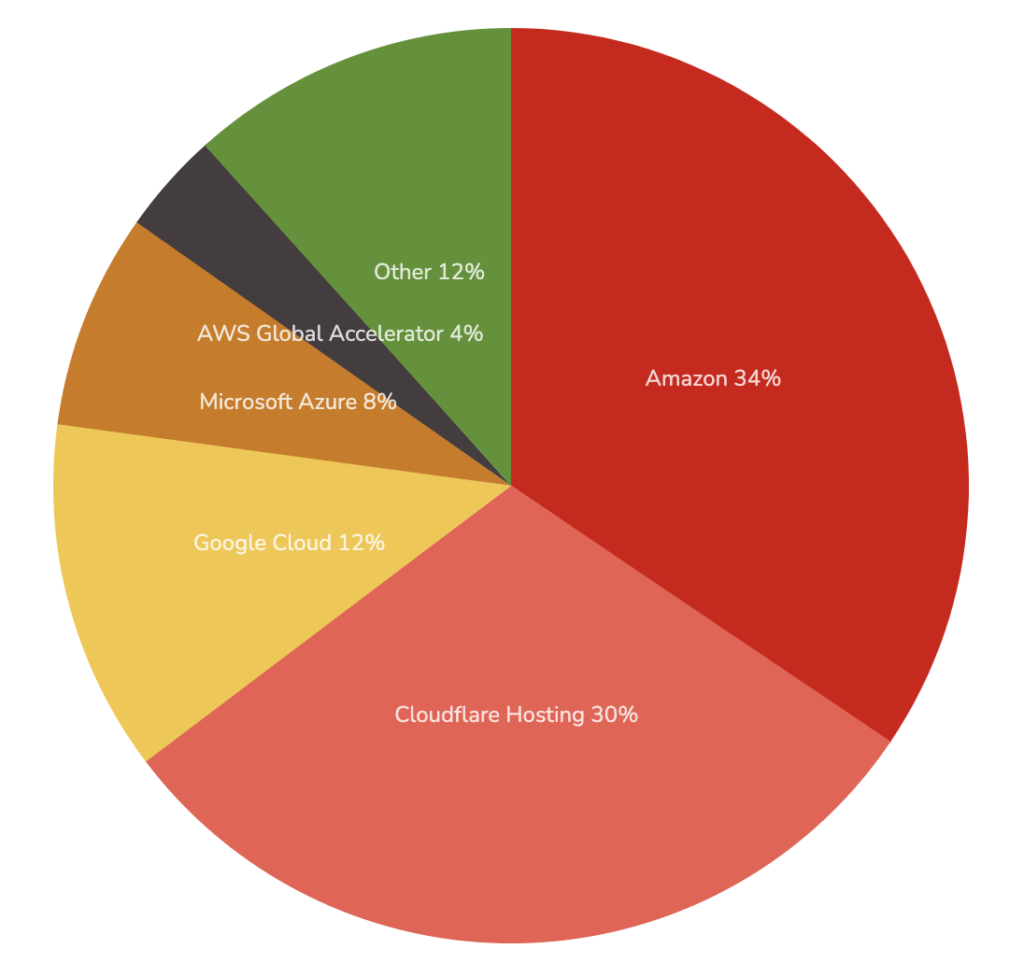

Cloud Hosting Usage Distribution in the Top 100k Sites

Statistics for websites using Cloud Hosting providers

With 34% market share among cloud hosting providers in the top 100k, Amazon owns the bigger piece of the visible internet out of the big three.

Google Cloud comes in at 12% and Microsoft Azure clocks in at just 8%, a share that’s over 4 times smaller than AWS.

But of course, the IaaS market isn’t just about web hosting either. In a survey, 47% of technical professionals said they were currently running significant workloads on AWS. Amazon’s platform as a service (PaaS) products for deployment are also the market leader.

AWS Historical and Current Revenue

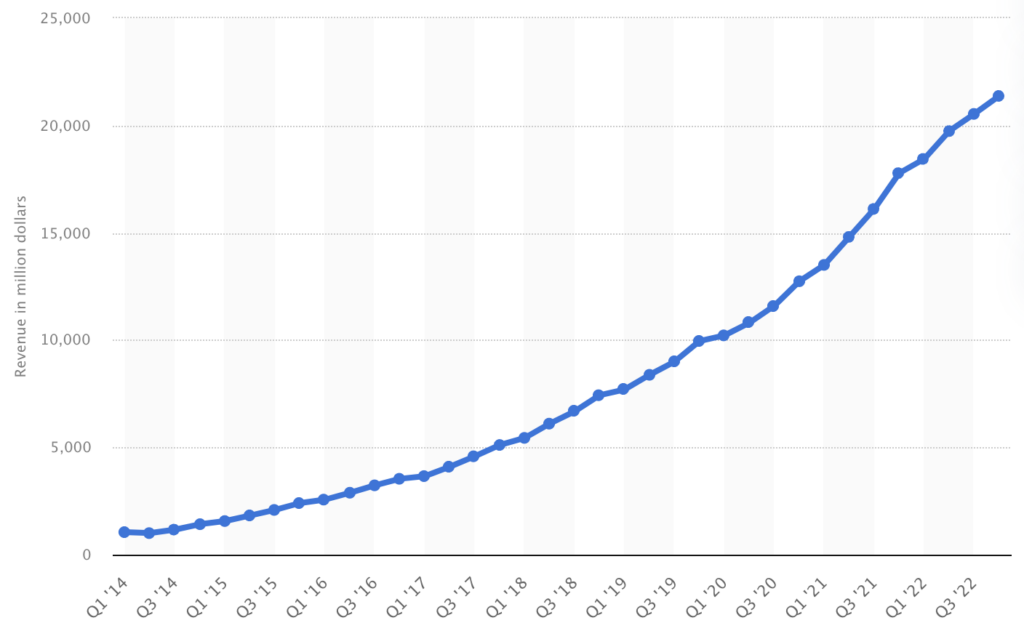

AWS quarterly and annual reports over the past ten years reveals a story of incredible growth.

In just ten years, the revenue has increased more than twenty five times over.

Annual revenue of AWS from 2013 to 2022

From $3.1 billion in 2013 to over $80 billion in 2022, the revenue growth of AWS has been steady, to say the least. It has shown that a cloud platform can not only be a billion-dollar business but a multi-billion, maybe even a hundred-billion dollar business.

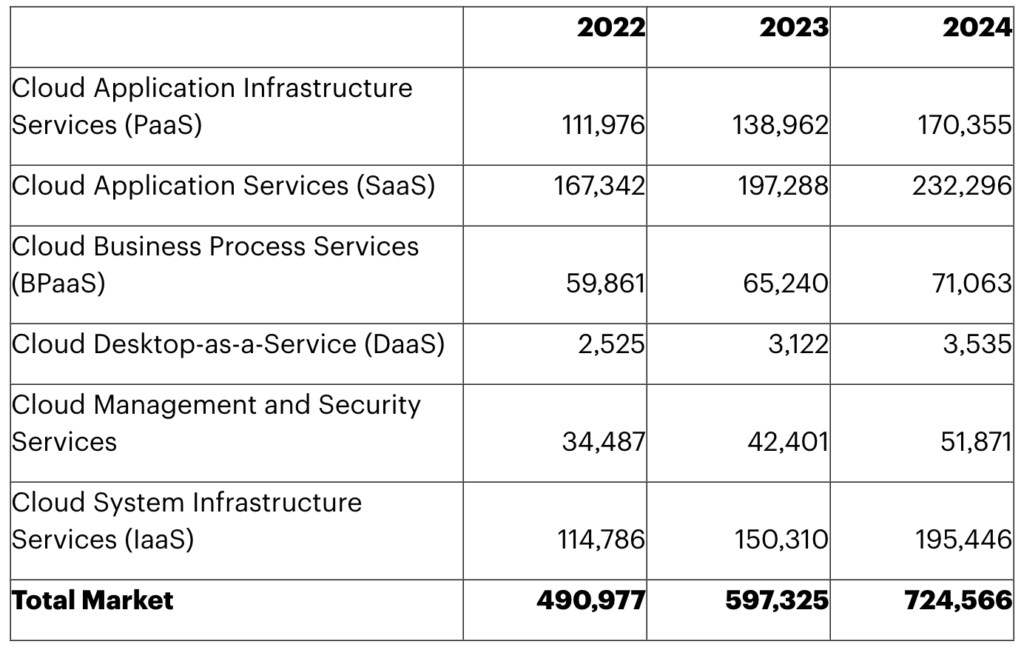

Will AWS Keep Growing its Share of the Cloud Market?

First, let’s take a look at the expected growth rate in the public cloud market in general. According to expert analysts at Gartner, total public cloud revenues will grow from $491 billion in 2022 to around $725 billion in 2024.

Worldwide Public Cloud Services End-User Spending Forecast (Millions of U.S. Dollars)

Source: Gartner (April 2023)

IaaS is forecasted to explode with an impressive 24% YoY growth rate. Together, IaaS and PaaS markets are expected to grow by more than $58 billion in revenue over the coming years.

Next, let’s take a look at AWS’s growth rate. AWS had an explosive growth rate early on, which showed signs of slowing in 2019. However, the company’s growth surged again at an even faster rate in recent years.

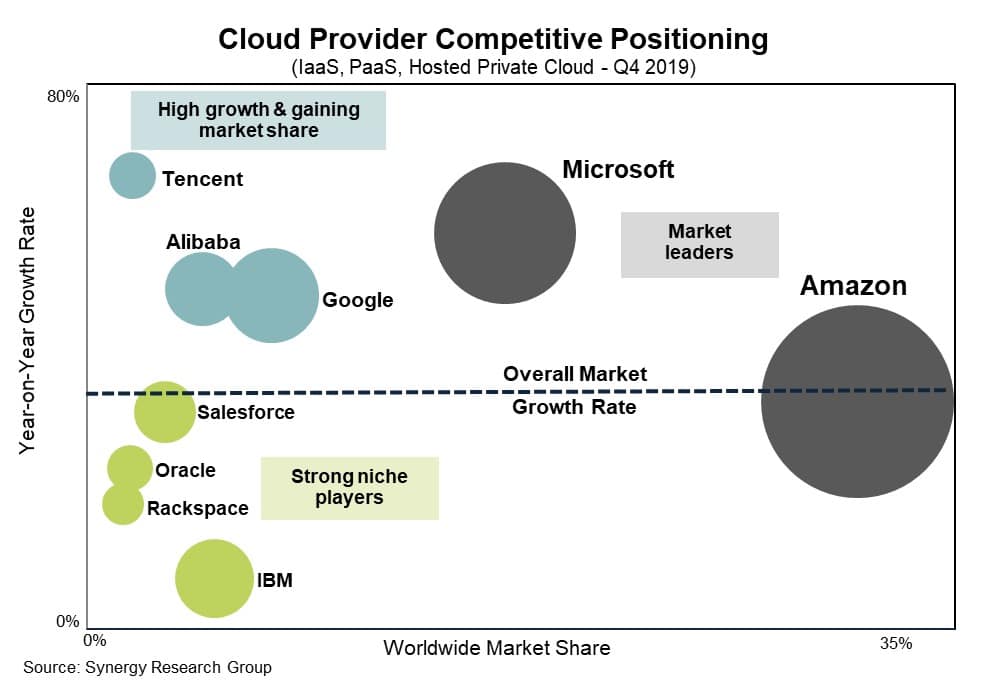

According to data from Synergy Research Group, in 2019 AWS growth began to slow compared to the overall market, while major competitors like Microsoft, Google, Alibaba, and Tencent continued to gain market share.

For example, Microsoft Azure established itself as one of the market leaders, by clocking in at 62% YoY growth Q4 2019, far above the average growth rate.

The other cloud solutions also matured, meaning AWS was no longer the clear-cut innovator and market leader.

Plus, many large enterprises don’t seem to like the idea of being solely reliant on a single cloud provider. That has led to the partial migration of some of AWS’s highest caliber clients, like Apple moving $400-600 million of cloud spending to Google Cloud Platform.

All in all, it seems likely that AWS will continue to grow at a sustainable rate, but lose market share as the pie grows to competitors that are growing at a faster clip, like Azure or Google.

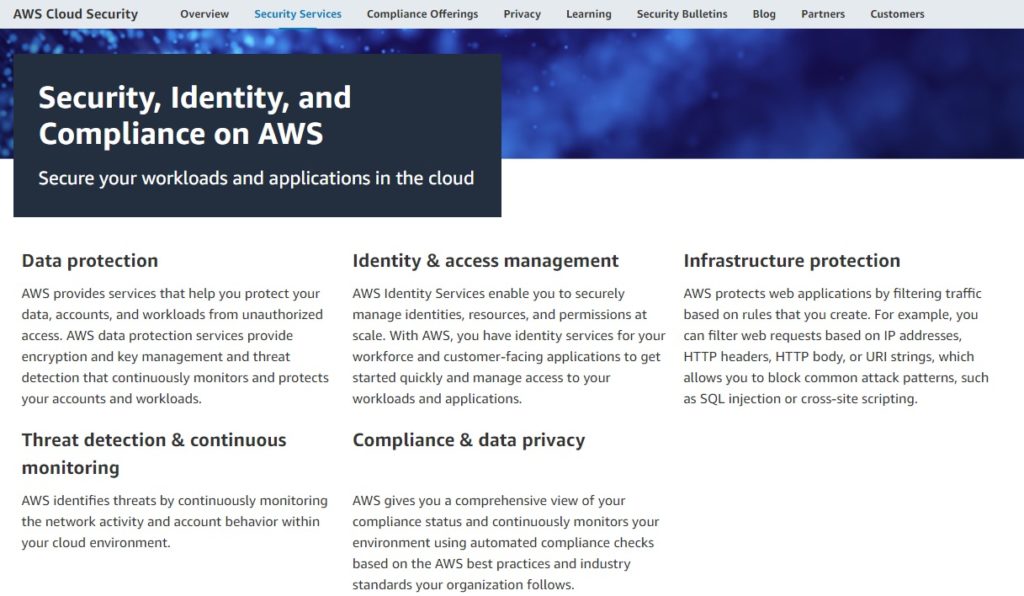

Is AWS Secure?

AWS is dedicated to maintaining a secure and compliant platform for its customers. You have scalable access control and encryption available for any sensitive data you want to process or store in the cloud.

Ongoing threat monitoring will help you detect and deal with potential security threats in real-time before they lead to an actual problem. But of course, no matter how secure a system is, you can’t always prevent user error.

Even the high profile Capital One case, which was caused by a disgruntled former employee, happened because sites had misconfigured their firewalls, leading to a vulnerability.

Vulnerabilities on individual accounts and websites due to misconfiguration are hard to avoid when you let customers configure and set up their own websites and systems.

AWS vs. Google Cloud Platform

So far, we’ve covered AWS’s general market share in cloud computing and services, but we haven’t looked at how they stack up against a competitor in particular.

In this section, we’ll do a deep dive into both AWS and the Google Cloud Platform, and see who comes out on top in different areas.

First, let’s take a look at how they stack up against each other in web hosting market share according to W3Techs data.

Historical trends in the usage statistics of hosting providers

Surprisingly, over the past year, Amazon lost a small amount of market share, down 0.2% when compared to 2022.

But when you examine the BuiltWith data on live websites, the numbers are much closer:

At 47.8 million and 45.4 million websites a piece, Amazon and Google Cloud are head and shoulders above other IaaS providers like Microsoft, with 1.2 million sites.

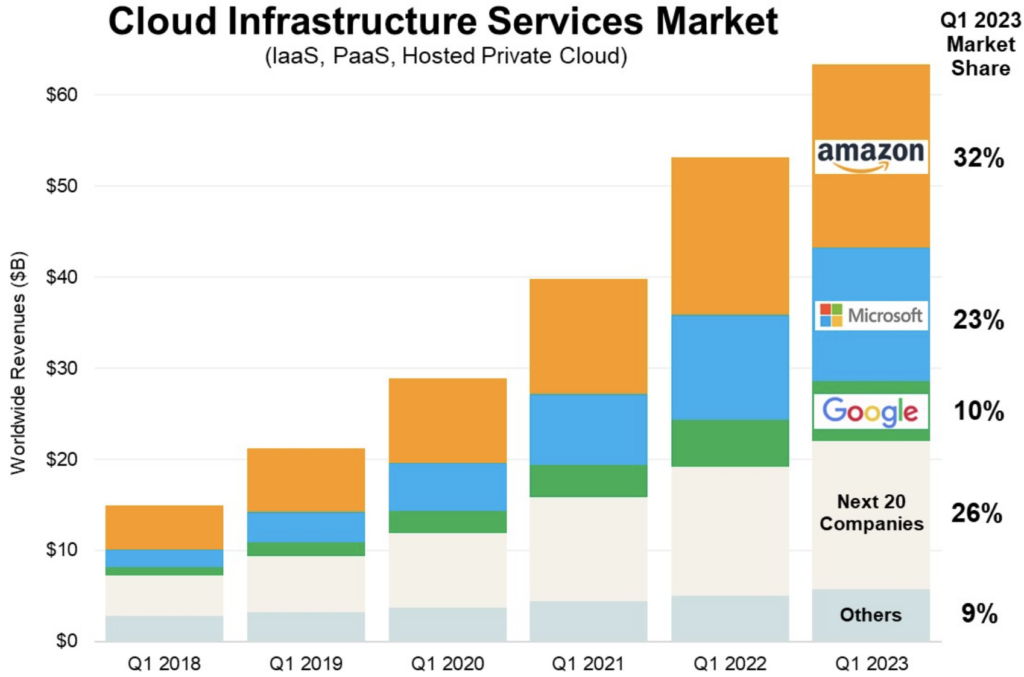

When it comes to the complete cloud revenue from IaaS, PaaS, and private cloud services, AWS has a much larger advantage over Google in terms of market share.

Their revenues reflect this. Despite the economic downturn in 2023, AWS hit a $85 billion annual run rate earlier this year, while Google Cloud exceeded all expectations with a $32 billion annual run rate.

Research from Synergy Research Group shows while AWS is still the clear winner, the gap is closing with Microsoft.

In 2023, AWS had a 32% market share, Microsoft 23%, and Google was in third place with 10%.

But market share isn’t everything. One of the most important factors when it comes to hosting and cloud services is reliability.

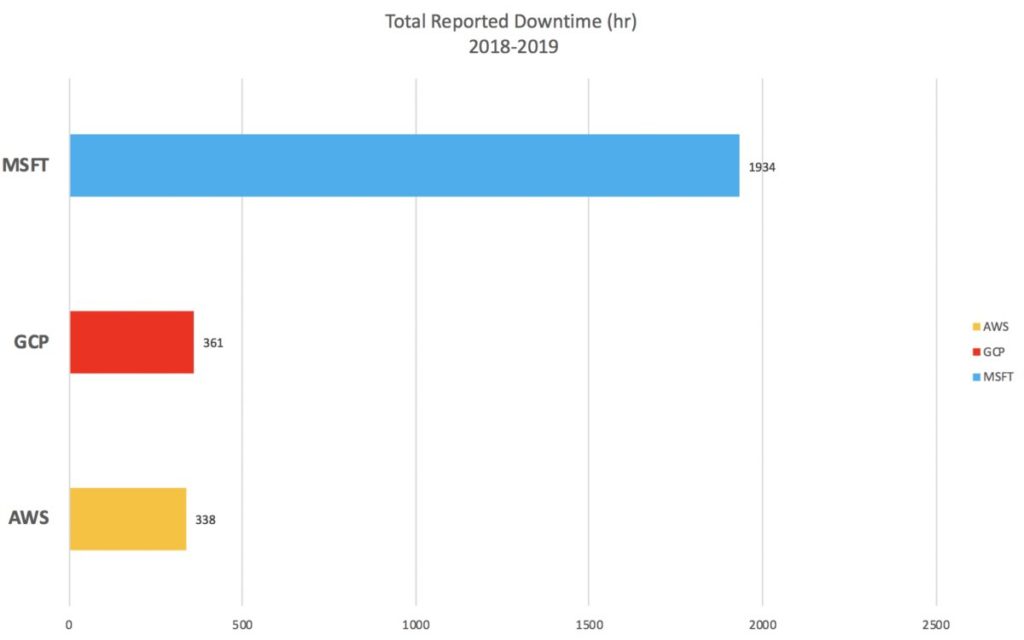

Google Cloud Platform and AWS are also industry leaders when it comes to uptime, with both only reporting a total of about 300 hours between May 2018 and May 2019.

On the surface, AWS was the slightly more reliable option, with 338 reported hours vs. Google GCP’s 361.

Azure and Google Cloud couldn’t be more different, with a difference of over 1,500 hours.

For more information, read our in-depth Google Cloud vs AWS comparison where we cover infrastructure, services, security, networks, latency, and more.

AWS vs. Microsoft Azure

Amazon and Microsoft are currently the two biggest players in the cloud infrastructure market, so it makes sense to compare AWS vs Azure side-by-side.

But the web hosting side of things tells a different story, according to the latest data from W3Techs.

At 6%, Amazon is the largest hosting provider, whereas at 1.2% Microsoft comes in after niche players like the page builders Wix and Squarespace.

Even in the top 10,000 most visited websites, AWS has a significant lead according to the latest data from BuiltWith.

Amazon has a 36% market share, while Azure is stuck at 8%.

When it comes to revenue, Microsoft doesn’t release Azure-specific revenue numbers, but according to one source, a recent court filing showed Microsoft Azure totaled $34 billion in revenue in 2022.

On the other hand, AWS more than doubled Azure, generating $80 billion in revenue in 2022.

Microsoft won another high-profile deal when they signed with the NBA for a multi-year deal to use Azure and Surface to provide personalized experiences to their customers.

High-profile public cloud deals going to Microsoft rather than AWS tip the scales even further in Microsoft’s favor, boosting their growth advantage.

But what if you care about more than just market share?

If you want to transition your website to the cloud, without having to own all the processes, we have the perfect solution for you.

Want the Power of the Cloud Without Feeling Like a Sysadmin?

Kinsta offers fast, secure, and feature-rich managed hosting for WordPress websites and agencies. Key features include 24/7/365 expert support with an average response time of under 2 minutes, available in ten languages.

Security features include LXD container technology for isolation, enterprise-level firewall, DDoS protection, a malware security pledge, and automatic daily backups.

Our infrastructure features performance-optimized cloud services with the fastest servers, 300+ CDN locations, enterprise-grade Cloudflare integration, and free migrations.